Press Center

Following the Wafer Foundry Model: What Piece is Still Missing in the Biotech CDMO Industry Puzzle?

Where is the next TSMC? In recent years,

Taiwan's biotech industry has been aggressively entering the Contract Development

and Manufacturing Organization (CDMO) market, sparking a wave of contract

manufacturing and being seen as the next "guardian mountain" of the

nation.

In the past, outsourcing carried somewhat

of a negative connotation. However, as TSMC has become a crucial partner in the

global semiconductor industry, it has once again proven the value of the

contract manufacturing business model. So why is production and manufacturing

also viable in the biotech industry?

In fact, Taiwan has demonstrated through

its semiconductor and IT industries how optimizing processes can accelerate

development. By the same logic, smart manufacturing might also work well in the

biotech industry.

CDMO stands for Contract Development and

Manufacturing Organization. Simply put, it refers to the outsourcing of

production services for various pharmaceuticals, including drugs, vaccines, and

medical devices. Since developing new drugs can take up to ten years, large

companies, although capable of building their own factories, often opt to

outsource production. This allows them to focus their funds on drug research

and development, control costs, and speed up time to market, making the CDMO

business model increasingly popular.

An Illustrated Guide to Understanding

CDMO

The most notable recent event in the

biotech industry is the passage of the dual laws on regenerative medicine,

which will help establish Taiwan's regenerative medicine industry.

Regenerative medicine is considered an

emerging medical treatment that mainly uses a large number of active cells or

gene-edited immune cells as drugs to treat difficult diseases. However, meeting

the demands of regenerative medicine is challenging due to the current

insufficiency of cell preparation and production capacity.

"Cell therapy is a rigid demand. If we

develop a CDMO manufacturing center, it can bring stable mass production and

quality standards to cell therapy and may help overcome industry

bottlenecks," said semiconductor giant Xu Jin-rong. It is understood that

he once suffered from nasopharyngeal cancer, which is why he is optimistic

about cell preparation CDMO. He believes that just like wafer foundries in the

semiconductor industry, CDMO will create greater value. Therefore, he has

quietly invested in biotech companies within the industry, hoping to use his

experience in semiconductor equipment to domestically produce medical equipment

and bring hope to cancer patients.

Industry insiders point out that while CDMO

is not an emerging industry, the urgent need for vaccines during the pandemic

highlighted the vulnerability of supply chains, making everyone aware of this

issue. Supply chain restructuring is happening not just in the tech industry

but also in biotech. Various countries aim to achieve supply chain autonomy,

making this the perfect time for CDMO companies to shine.

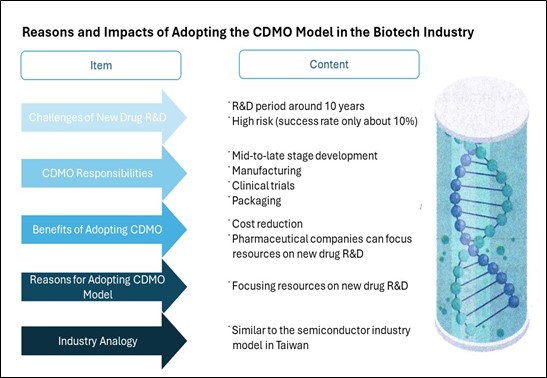

Why does the biotech industry need CDMO?

The main reason is that new drug development is time-consuming and risky, with

a success rate of only about 10%. It usually takes 10 years from clinical

trials to obtaining drug approval. To focus resources on new drug development,

pharmaceutical companies outsource the middle and later stages of development,

manufacturing, clinical trials, and packaging to reduce costs. This model is

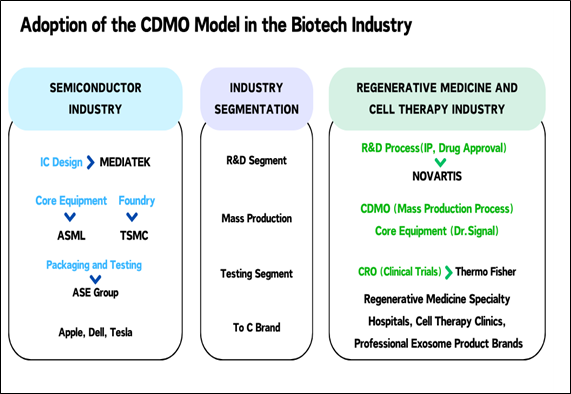

quite similar to the familiar semiconductor industry in Taiwan.

Simply put, companies like MediaTek,

Qualcomm, NVIDIA, and AMD contract TSMC for wafer foundry services, while

biotech companies or pharmaceutical firms, similar to these fabless

semiconductor companies, mainly focus on R&D. CDMO, in short, operates similarly

to TSMC's business. If a new drug is favored by a pharmaceutical company and

deemed to have market potential, the company contracts a CRO (Contract Research

Organization) to provide clinical trial services and help obtain drug approval.

In the semiconductor analogy, the role of

CRO is similar to packaging and testing companies like ASE Group and

Siliconware Precision Industries.

The difference lies in the fact that the

most direct profit for biotech pharmaceutical companies is obtaining drug

approvals from authorities like Taiwan's TFDA and various international FDAs as

soon as possible. This gives them the right to manufacture and sell drugs,

enabling large-scale production and sales. For biotech pharmaceutical

companies, securing drug approval is the most critical hurdle for new drug

commercialization. Drug approvals must be granted by health authorities in each

country, and CROs play a crucial role as key intermediaries. In contrast,

regulations and standards in the semiconductor industry are dictated by

industry leaders.

What Piece is Still Missing in the CDMO

Supply Chain?

Industry insiders in regenerative medicine

point out that once the "dual laws on regenerative medicine" are

passed, and both public and private insurance cover the treatments, the number

of patients receiving these therapies could increase by more than tenfold,

potentially making cell therapy more widespread. However, there are two

existing barriers: first, the traditional reliance on manual production, which

prevents price reduction, and second, the lack of clear division of labor

within the industry.

Typically, the more mature an industry, the

higher its division of labor. CDMO is often compared to wafer foundries, but a

closer look reveals that one reason Taiwan's semiconductor industry holds such

influence is due to its highly specialized supply chain. In contrast, the

division of labor and positioning in the CDMO of regenerative medicine and the

broader biotech industry are far less clear.

Industry insiders acknowledge that many

biotech companies in Taiwan currently handle everything from new drug

development and clinical trials to manufacturing and end-market sales. However,

one should ask, is there any semiconductor company that simultaneously manages

design, production, and packaging? Even though South Korea's Samsung

Electronics can be considered a comprehensive semiconductor company, it faces

awkward competition in AI semiconductors.

The most serious issue is that biotech

companies should not attempt to recoup their initial investments by venturing

into branding and the end market to make quick profits, akin to MediaTek

selling smartphones to push their chips directly to consumers.

Additionally, insiders note that Taiwan's

biotech research and development are impressive. However, at this stage, both

government and private resources and funding are often not concentrated. Talent

is dispersed across different small companies, often working in the same field,

resulting in unclear division of labor. For Taiwan's biotech industry to

advance, medium-sized biotech companies need to merge and integrate, or funds

should be used to consolidate several small companies into globally competitive

mid-to-large companies, thereby attracting more international investment.

Resources are limited and must be allocated correcly.

Moreover, while Taiwan is actively

developing CDMO, it is primarily responsible for mass production. The key

remains in the early-stage R&D; otherwise, the volume of orders will not

support mass production demand. Industry experts believe that instead of a

scattergun approach, resources should be concentrated, such as focusing on new

drug development, allowing both R&D and manufacturing to thrive in tandem,

achieving a supply-demand balance and stimulating healthy industry development.

Yang Yu-min, former Global Head of

Technical Operations at Roche and chairman of Yourgene Health, often referred

to as the Morris Chang of the biotech industry, also urges that Taiwan should

focus on R&D innovation-based biotech and CDMO to seize the golden

opportunity in the post-pandemic capital market.

Reasons and Impacts of the Biotech Industry Adopting the CDMO Model

CDMO Must Follow the Market

Compared to OEM and ODM commonly seen in

manufacturing, the terms more frequently used in biotech and pharmaceuticals

are Contract Manufacturing Organization (CMO) and Contract Development and

Manufacturing Organization (CDMO). The key difference is that CDMOs focus more

on product development. They work closely with clients during the development

phase, sometimes even co-developing or designing products, thus aiding more

research-focused companies in technology transfer.

Former director of ITRI's Biomedical

Technology and Device Research Laboratories, Lin Qi-wan, has publicly stated

that CDMOs have patents, understand processes, and possess expertise in their

respective fields, knowing how to add value and innovate products. With the

example of TSMC in front, the industry is optimistic about the future,

believing that "those who master the process will rule the world."

As AI enters a new wave of arms race,

Taiwan is undoubtedly the world's most important chip production base. The

recent global chip shortage has highlighted Taiwan's status and unexpectedly

boosted the performance of China Airlines and EVA Air. However, the logic of

building a cell preparation CDMO must be market-oriented. Industry insiders

state that since cell therapy requires patient-derived samples and cells are

living organisms with transport limitations, production must occur near the

patient's location.

Thus, the ideal business model is to

collaborate with large local medical institutions, leveraging their patient

absorption capacity to solve transportation issues. For CDMO companies, their

ability to export entire factories will be key to securing orders and business

development.

Furthermore, although cell therapy is an

emerging treatment, rapid development is challenging if relying solely on

manually cultured cells. Therefore, process automation and intelligence are

necessary. It is understood that combining AI, AR, and automation can increase

cell production tenfold compared to traditional laboratories, and the cost per

hundred million cells prepared is only one-tenth of traditional manual

culturing.

Earlier, NVIDIA CEO Jensen Huang remarked

that life sciences would be the next big thing and that the future lies in

bioengineering. It's not hard to understand why Huang, standing at the peak of

the AI wave, would say this. Generative AI benefits various industries,

possibly reducing the need for extensive talent, but the biotech industry, with

its high economic value, is still in its infancy in AI development. Biotech

industry insiders agree with Huang's perspective.

Historically, Taiwan has only been able to

follow international giants in the development of small and large molecule

drugs. For currently incurable diseases, regenerative medicine offers patients

a glimmer of hope and is an emerging industry. Asian countries, including Japan

and China, view the development of regenerative medicine as an opportunity to

leapfrog ahead.

Now that the dual laws on regenerative

medicine have finally passed, the industry has a new opportunity to advance.

Taiwan's advantage lies in its smart manufacturing capabilities, proven in the

semiconductor and IT industries. How to replicate this success perfectly in the

biotech industry and foster rapid development in regenerative medicine is

something Taiwan is confident about.

Chen Qi-hong, chairman of Qisda, who has

been involved in the medical industry for 20 years after transitioning from an

electronics manufacturing giant, has stated that the business strategies of

electronics and medical industries are fundamentally opposite. Developing

pharmaceuticals is difficult, but successfully bringing them to market is even

harder. Unlike electronics, where specifications are relatively uniform and

regulatory approval takes only a few months and is globally applicable, the

medical industry has high entry barriers.

Regulations such as the US FDA, Taiwan

TFDA, and EU CE each have their systems, which are not universally applicable

and are relatively strict and time-consuming. Often, even after successfully

obtaining approval, the specifications may become outdated due to the lengthy

process, potentially requiring resubmission. The long pre-market journey, with

its high costs and resources, is daunting. If downstream sales are poor and

later returns are not guaranteed, the pressure can be immense.

Source:DIGITIMES